Filling out a W-9 form can be a daunting task, especially for nonprofits that may not be familiar with the process. Nonprofits often need to provide their taxpayer identification information when working with contractors, vendors, or other organizations. Understanding how to fill out a W-9 for a nonprofit can streamline this process and ensure compliance with IRS regulations. The W-9 form serves as a request for taxpayer identification and certification, and it's crucial for nonprofits to fill it out correctly to avoid any potential issues. In this article, we will guide you through the steps of completing a W-9 for your nonprofit organization, making it easier for you to manage your financial responsibilities.

In addition to providing essential information about your nonprofit, a properly filled W-9 can help you avoid delays in payments and ensure that you are compliant with tax laws. It's important to understand the purpose of the form, what information is required, and how to submit it effectively. By the end of this article, you'll have a comprehensive understanding of how to fill out a W-9 for a nonprofit and be better prepared to handle financial transactions.

Whether you are a new nonprofit or an established organization, mastering the W-9 form is an essential part of your financial operations. This guide will provide you with the confidence and knowledge you need to successfully navigate this important task. Let’s dive into the details of how to fill out a W-9 for a nonprofit and ensure your organization is ready for any financial interactions.

What is a W-9 Form?

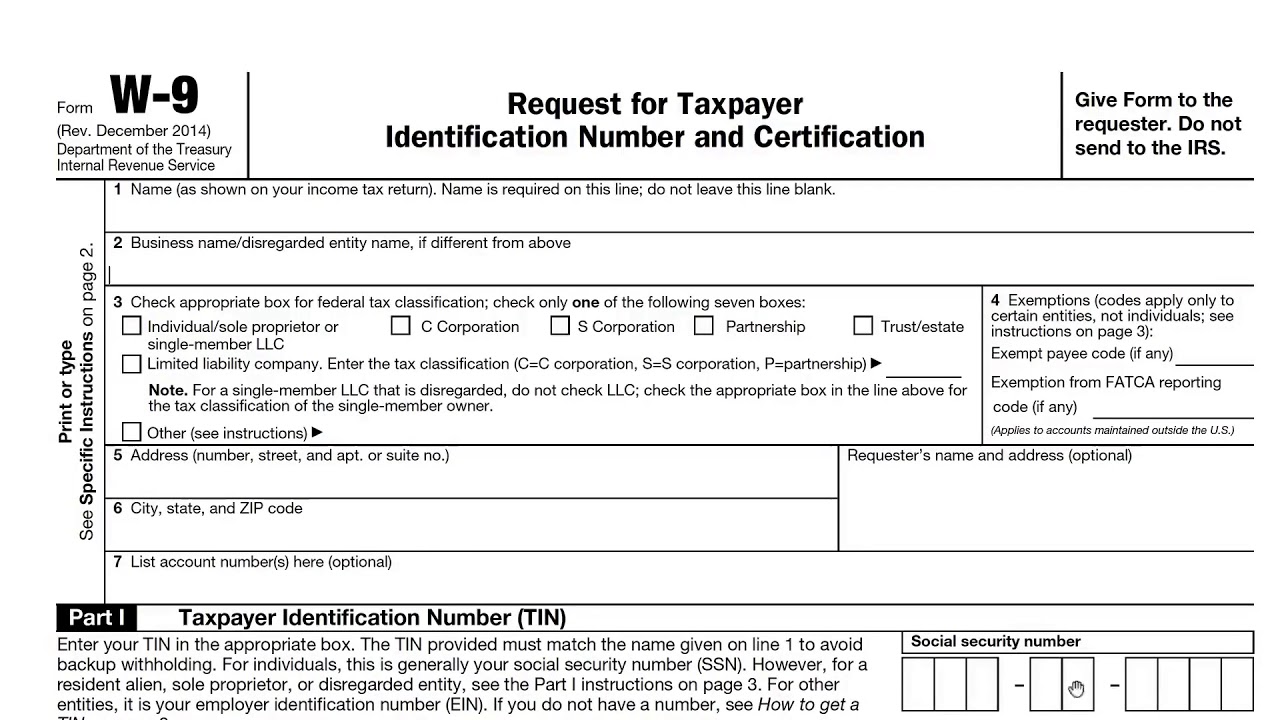

The W-9 form, officially known as the "Request for Taxpayer Identification Number and Certification," is a document used by organizations to provide their taxpayer identification information to others. This form is primarily used by businesses and nonprofits to report income paid to them to the Internal Revenue Service (IRS). For nonprofits, it’s essential to complete this form accurately to maintain their tax-exempt status.

Why Do Nonprofits Need to Fill Out a W-9?

Nonprofits often engage with various vendors, contractors, and grantors who may require their taxpayer identification number for tax reporting purposes. Filling out a W-9 for a nonprofit ensures that:

- Payments made to the nonprofit are properly documented.

- The nonprofit can receive funds without delay.

- The organization maintains compliance with tax regulations.

Who Requests a W-9 Form from Nonprofits?

Several entities may request a W-9 form from nonprofits, including:

- Contractors and service providers

- Grant-making organizations

- Companies providing goods or services

How to Fill Out a W-9 for a Nonprofit?

Filling out a W-9 for a nonprofit involves several steps. Here’s a detailed guide on how to complete this form:

- Download the W-9 Form: You can find the W-9 form on the IRS website. Make sure you have the most recent version.

- Provide the Nonprofit's Name: In the first line, enter the legal name of your nonprofit organization as it appears on the IRS records.

- Enter the Business Name (if different): If your nonprofit operates under a different name, include it in the second line.

- Select the Appropriate Entity Type: Check the box for “Exempt payee” to indicate that your nonprofit is tax-exempt.

- Provide the Mailing Address: Include the complete mailing address where you receive correspondence.

- Enter the Taxpayer Identification Number (TIN): For nonprofits, this is usually the Employer Identification Number (EIN).

- Sign and Date the Form: Finally, sign and date the form to certify that the information provided is accurate.

What Information is Required on the W-9?

When filling out a W-9 for a nonprofit, the following information is typically required:

- Legal Name: The official name of the nonprofit.

- Business Name: Any alternate name used by the nonprofit.

- Federal Tax Classification: Mark the appropriate box for your organization.

- Address: The nonprofit's mailing address.

- Taxpayer Identification Number: The EIN assigned to the nonprofit.

Where to Submit the Completed W-9?

Once you have completed the W-9 form for your nonprofit, it is important to know where to submit it. The completed form should be sent directly to the entity that requested it, whether it be a vendor, contractor, or grantor. Do not send the W-9 to the IRS unless specifically instructed to do so.

Common Mistakes to Avoid When Filling Out a W-9

To ensure your W-9 form is accepted without issues, avoid these common mistakes:

- Entering incorrect taxpayer identification numbers.

- Failing to sign and date the form.

- Providing an outdated version of the W-9 form.

What Happens After Submitting the W-9 Form?

After submitting the W-9 form for your nonprofit, the requesting entity will use the information provided to report payments to the IRS. It’s advisable to keep a copy of the completed form for your records. This ensures that you have a reference in case of any discrepancies or questions regarding the payments made to your organization.

How Often Should Nonprofits Update Their W-9?

Nonprofits should update their W-9 form any time there are changes to their information, such as:

- Changes in the organization's name or structure.

- Changes in the taxpayer identification number.

- Changes in mailing address.

It’s also a good practice to review and update the W-9 form annually to ensure all information is current.

Conclusion: Navigating the W-9 Process with Confidence

Understanding how to fill out a W-9 for a nonprofit is essential for ensuring smooth financial operations and compliance with IRS regulations. By following the steps outlined in this article, your nonprofit can effectively manage its financial interactions with various entities. Remember that accurate completion of the W-9 can help avoid potential delays in payments and maintain your nonprofit’s good standing. If you have any further questions about the W-9 process, do not hesitate to consult with a financial advisor or tax professional.

Article Recommendations

- Old Dollar Shave Club Handle

- Glenn Plummer

- Opera Singer Marina Viotti

- Motion Ai Vs

- Zhang Xueying

- Bec And Bridge Bridesmaid

- G3 Case

- Luisa Baratto

- How To Use Rabbitfx

- Sherell Ford