What's the difference between a bill and an invoice? This is a common question that many people, even business professionals, find themselves pondering. Whether you're a small business owner, an accounting student, or simply someone curious about the nuances of financial documents, understanding the differences and similarities between a bill and an invoice is crucial for effective financial management. Both terms are often used interchangeably, yet they serve distinct purposes and have unique characteristics that set them apart. To help clarify this topic, this article delves into the details of bills and invoices, exploring their definitions, functions, and the contexts in which they are used.

In the world of business and finance, terminology can sometimes be confusing, leading to misunderstandings and errors. However, gaining clarity on the terminology can significantly enhance one's ability to manage finances accurately and efficiently. A well-informed approach to managing financial documents is essential for maintaining transparency, ensuring timely payments, and fostering positive business relationships. By distinguishing between a bill and an invoice, you can better organize your financial records, streamline your accounting processes, and avoid potential disputes or misunderstandings with clients and suppliers.

Throughout this article, we will provide an in-depth analysis of bills and invoices, comparing their features, functions, and applications. We'll cover various aspects, such as legal implications, components, and examples, to ensure a thorough understanding. Additionally, we'll address common questions and misconceptions related to these financial documents. Whether you're new to the topic or looking to enhance your existing knowledge, this comprehensive guide aims to equip you with the expertise needed to confidently navigate the complexities of bills and invoices.

Table of Contents

- Definition of a Bill

- Definition of an Invoice

- Key Differences Between Bill and Invoice

- Components of a Bill

- Components of an Invoice

- Legal Implications of Bills and Invoices

- Functions and Uses of Bills

- Functions and Uses of Invoices

- Billing Process in Different Industries

- Invoicing Process in Different Industries

- Common Misconceptions About Bills and Invoices

- Best Practices for Managing Bills and Invoices

- Technology and Automation in Billing and Invoicing

- Frequently Asked Questions

- Conclusion

Definition of a Bill

A bill is a formal written document that outlines the amount owed by a buyer to a seller for goods or services provided. It serves as a request for payment and is typically issued immediately following the provision of goods or services. Bills are commonly used in day-to-day transactions, such as dining at a restaurant, purchasing groceries, or receiving utilities. The document specifies the details of the transaction, including the date, description of goods or services, quantity, unit price, and the total amount due.

Bills are usually generated during the point of sale and are handed over to the customer as proof of the transaction. They are an essential part of business operations as they serve as a record for both the buyer and the seller. For the customer, a bill is a reminder of the payment due, whereas for the business, it acts as a record for accounting and inventory purposes.

One of the key characteristics of a bill is its immediacy. Unlike invoices, which may have longer payment terms, bills often require prompt payment, typically at the time of service or purchase. This immediacy is particularly common in retail and hospitality sectors, where transactions are completed quickly, and payment is expected on the spot. As such, the bill plays a crucial role in the cash flow of businesses within these industries.

Definition of an Invoice

An invoice is a commercial document issued by a seller to a buyer, detailing the goods or services supplied and the agreed payment terms. Unlike a bill, an invoice can be issued before or after the delivery of goods or services, depending on the agreement between the parties involved. Invoices are commonly used in business-to-business (B2B) transactions and are essential for maintaining clear and transparent financial records.

Invoices serve multiple purposes. For sellers, they act as a formal request for payment and help monitor accounts receivable. For buyers, invoices provide a detailed account of the transaction, allowing them to verify the accuracy of the charges and the specifics of the purchase. Invoices often include essential information such as the invoice number, date of issue, payment terms, contact details of both parties, and an itemized list of goods or services provided.

The flexibility of invoices in terms of payment terms is one of their defining features. Payment terms may vary, ranging from immediate payment upon receipt of the invoice to net 30, net 60, or even longer. This flexibility allows businesses to manage their cash flow more effectively and maintain healthy business relationships. As such, invoices play a pivotal role in ensuring smooth financial operations and fostering trust between businesses.

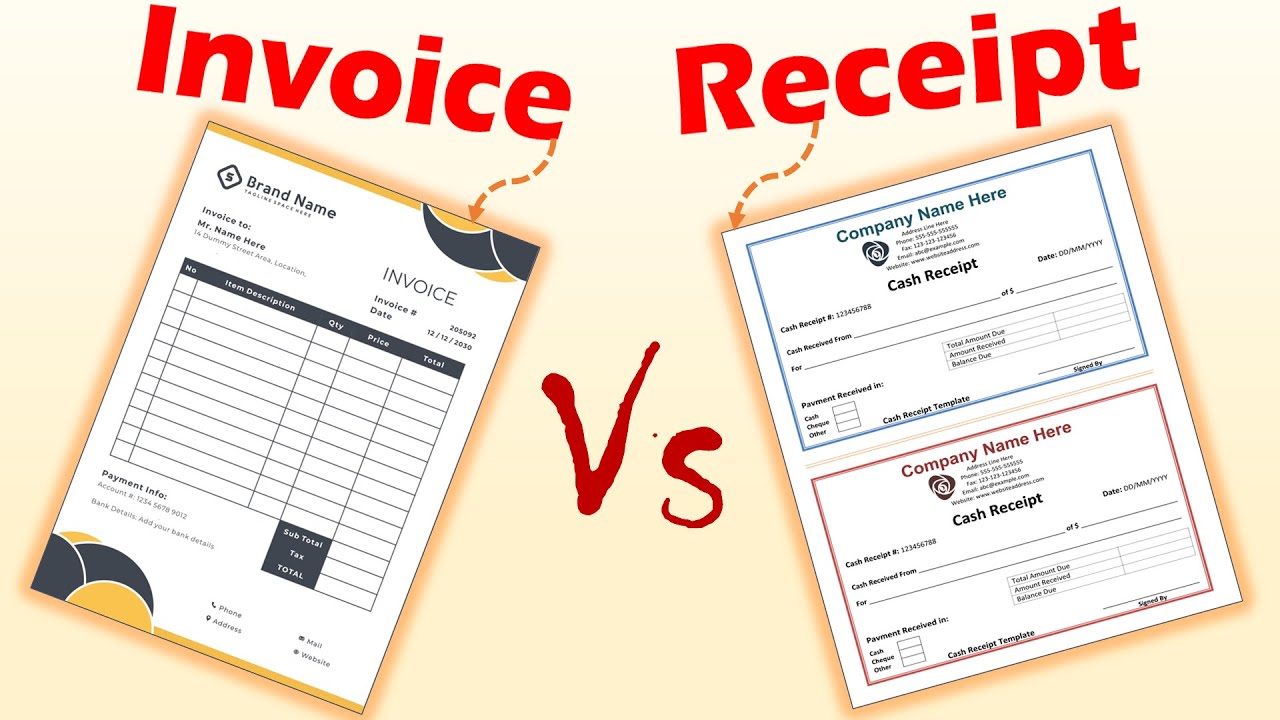

Key Differences Between Bill and Invoice

Understanding the distinctions between a bill and an invoice is crucial for effective financial management. While the two terms are often used interchangeably, they have distinct differences that set them apart. One of the primary differences lies in their purpose and timing. A bill is typically issued when immediate payment is required, such as in retail or hospitality transactions, whereas an invoice is used when payment is expected within a specified period, often in B2B transactions.

Another key difference is the level of detail provided. Invoices usually contain more comprehensive information compared to bills. This includes details such as payment terms, due dates, and contact information for both parties involved. Bills, on the other hand, tend to be more straightforward, listing only the necessary details needed to complete the transaction, such as the total amount due and a brief description of the goods or services.

Furthermore, the terminology used can vary depending on the context. In some regions and industries, the terms "bill" and "invoice" might be used interchangeably, leading to confusion. However, it's essential to understand the underlying purpose and timing of these documents to avoid misunderstandings. By recognizing these differences, businesses and individuals can ensure accurate record-keeping and effective financial communication.

Components of a Bill

A well-structured bill includes several key components that provide clarity and transparency for both the buyer and the seller. These components ensure that all necessary information is communicated effectively, minimizing the chances of disputes or errors. Common components of a bill include:

- Date of Transaction: The date on which the transaction occurred, providing a reference for both parties.

- Description of Goods or Services: A brief overview of the items purchased or services rendered.

- Quantity and Unit Price: The number of items or units provided, along with the cost per unit.

- Total Amount Due: The total sum owed by the buyer, calculated based on the quantity and unit price.

- Payment Terms: Although not always included, some bills may specify the expected payment method or timeframe.

These components are essential for ensuring that both parties have a clear understanding of the transaction details. For businesses, having a standardized format for bills can improve efficiency and accuracy in their accounting processes. Additionally, it provides customers with a clear and concise record of their purchases, facilitating smoother payment transactions.

Components of an Invoice

Invoices play a vital role in business transactions, offering a detailed account of goods or services provided and the associated costs. Unlike bills, invoices are generally more comprehensive, including various components that ensure transparency and accuracy. These components typically consist of:

- Invoice Number: A unique identifier for each invoice, helping both parties track and reference the transaction.

- Date of Issue: The date the invoice was created and sent to the buyer.

- Supplier and Buyer Information: Contact details of both the supplier and the buyer, including names, addresses, and phone numbers.

- Description of Goods or Services: A detailed list of the goods or services provided, including specifications, quantities, and prices.

- Payment Terms: The agreed-upon terms for payment, outlining the due date and any applicable discounts or penalties.

- Total Amount Due: The total sum owed by the buyer, including any applicable taxes or fees.

These components collectively ensure that both parties have a clear understanding of the transaction, reducing the likelihood of disputes or errors. For businesses, maintaining detailed and accurate invoices is crucial for efficient accounts receivable management and financial record-keeping. By following a consistent invoicing format, companies can streamline their billing processes and ensure timely payments.

Legal Implications of Bills and Invoices

Both bills and invoices carry legal implications that businesses and individuals must be aware of to ensure compliance and avoid potential disputes. Understanding these legal aspects is essential for maintaining transparency and trust in financial transactions. One of the primary legal implications is the enforceability of payment terms. Both bills and invoices serve as formal requests for payment, and the terms outlined within them are legally binding agreements between the buyer and the seller.

In the case of invoices, the payment terms specified are crucial for determining when the payment is due and any penalties for late payments. It's important for businesses to clearly communicate these terms to avoid misunderstandings. Additionally, invoices may include clauses related to interest charges on overdue payments, further emphasizing the importance of timely payment.

Bills, while often requiring immediate payment, also carry legal weight as proof of the transaction. They serve as evidence of the goods or services provided and the amount owed, making them essential documents in the event of disputes. Understanding the legal implications of bills and invoices is crucial for businesses to protect their interests and maintain positive relationships with clients and suppliers.

Functions and Uses of Bills

Bills serve a variety of functions and uses in both personal and business contexts. They are primarily used as a request for payment, providing a clear and concise record of the transaction. This function is particularly important in retail and hospitality sectors, where transactions are completed quickly, and payment is required immediately.

In addition to serving as a request for payment, bills also function as a record-keeping tool. They provide a detailed account of the goods or services provided, helping businesses track sales and manage inventory. For consumers, bills serve as proof of purchase, allowing them to verify charges and keep track of their spending.

Another important function of bills is to facilitate accurate accounting and financial reporting. By maintaining detailed records of all transactions, businesses can ensure that their financial statements are accurate and up-to-date. This is essential for managing cash flow, preparing tax returns, and making informed business decisions. Overall, bills play a crucial role in ensuring smooth financial operations and effective communication between buyers and sellers.

Functions and Uses of Invoices

Invoices are indispensable tools in the business world, serving multiple functions and uses that facilitate smooth financial operations. One of the primary functions of an invoice is to serve as a formal request for payment, outlining the terms and conditions under which payment is expected. This not only provides clarity for the buyer but also helps businesses manage their cash flow by setting clear expectations for payment timelines.

In addition to requesting payment, invoices also play a vital role in record-keeping and financial reporting. They provide a detailed account of the transaction, including specifics about the goods or services provided, quantities, prices, and payment terms. This information is crucial for accurate accounting and financial analysis, helping businesses track sales, manage accounts receivable, and prepare financial statements.

Invoices also serve as legal documents, providing evidence of the transaction and the agreed-upon terms. This is particularly important in the event of disputes or disagreements, as the invoice can be used to verify the details of the transaction and the obligations of both parties. By maintaining accurate and detailed invoices, businesses can ensure transparency, build trust with clients, and protect their interests in legal matters.

Billing Process in Different Industries

The billing process can vary significantly across different industries, reflecting the unique needs and practices of each sector. Understanding these variations is crucial for businesses to ensure efficient and accurate billing, maintain positive relationships with clients, and manage cash flow effectively.

In the retail industry, the billing process is often straightforward and immediate. Transactions are typically completed at the point of sale, with customers receiving a bill or receipt for their purchases. This process is designed to be quick and efficient, allowing for high volumes of transactions and immediate payment. In contrast, the hospitality industry may involve more complex billing processes, particularly in cases where services are provided over an extended period, such as hotel stays or event catering. In these scenarios, bills may be issued at the end of the service period, consolidating charges for various services and amenities.

The billing process in healthcare is another area where complexity can arise. Medical bills often involve numerous line items for different services, procedures, and medications, as well as negotiations with insurance companies. This can result in lengthy billing cycles and the need for specialized billing systems to manage the process effectively.

Understanding the billing process in different industries is essential for businesses to tailor their practices to meet the specific needs of their sector. By implementing efficient billing processes, companies can ensure timely payments, reduce errors, and enhance customer satisfaction.

Invoicing Process in Different Industries

Similar to billing, the invoicing process can vary widely across different industries, reflecting the diverse needs and practices of each sector. Understanding these variations is crucial for businesses to ensure efficient and accurate invoicing, manage accounts receivable, and maintain positive relationships with clients.

In the construction industry, the invoicing process often involves progress billing, where invoices are issued at various stages of a project based on the work completed. This approach allows construction companies to manage cash flow effectively and ensure that they are compensated for work as it is completed. In contrast, the manufacturing industry may involve more straightforward invoicing processes, with invoices issued based on the delivery of finished goods to customers.

The professional services industry, such as legal or consulting services, often involves time-based invoicing, where charges are based on the hours worked by professionals. This requires accurate time-tracking and detailed invoicing to ensure that clients are billed accurately for the services provided. In the technology sector, invoicing processes may involve subscription-based billing, where customers are invoiced on a recurring basis for access to software or services.

By understanding the invoicing process in different industries, businesses can tailor their practices to meet the specific needs of their sector. Implementing efficient invoicing processes can help companies manage accounts receivable, ensure timely payments, and enhance client satisfaction.

Common Misconceptions About Bills and Invoices

Despite their importance in financial transactions, bills and invoices are often misunderstood, leading to common misconceptions. One prevalent misconception is that bills and invoices are the same thing. While they share similarities, such as requesting payment, they serve distinct purposes and have different characteristics. Understanding these differences is crucial for effective financial management and communication.

Another common misconception is that bills and invoices are only relevant to businesses. In reality, both documents play a vital role in personal finance as well, helping individuals manage their expenses and maintain accurate records of their transactions. By understanding the functions and uses of bills and invoices, individuals can better organize their finances and avoid potential disputes or errors.

Additionally, there is often confusion surrounding the legal implications of bills and invoices. Some people may mistakenly believe that these documents are not legally binding, leading to misunderstandings and disputes. However, both bills and invoices serve as formal requests for payment and carry legal weight, making it essential for businesses and individuals to understand their obligations and rights under these documents.

Addressing these misconceptions is crucial for ensuring accurate financial communication and effective management of financial transactions. By gaining a clear understanding of the differences between bills and invoices, individuals and businesses can enhance their financial literacy and improve their financial practices.

Best Practices for Managing Bills and Invoices

Effective management of bills and invoices is crucial for maintaining financial health and ensuring smooth business operations. Implementing best practices in managing these documents can help businesses streamline their processes, reduce errors, and enhance customer satisfaction.

One of the best practices for managing bills and invoices is to establish a standardized format for both documents. This ensures consistency and clarity in communication, reducing the likelihood of misunderstandings or disputes. Additionally, using software or digital tools to generate and manage bills and invoices can improve efficiency and accuracy, allowing businesses to automate repetitive tasks and reduce the risk of errors.

Another important practice is to establish clear payment terms and communicate them effectively to customers. This includes specifying due dates, payment methods, and any applicable discounts or penalties for late payments. By setting clear expectations, businesses can enhance cash flow management and reduce the risk of late or missed payments.

Regularly reviewing and reconciling bills and invoices is also essential for maintaining accurate financial records. This involves comparing bills and invoices with purchase orders, contracts, or delivery notes to ensure that all charges are accurate and accounted for. By implementing these best practices, businesses can improve their financial management, reduce errors, and enhance customer satisfaction.

Technology and Automation in Billing and Invoicing

Advancements in technology and automation have revolutionized the way businesses manage billing and invoicing processes. By leveraging digital tools and software solutions, companies can streamline their operations, reduce errors, and enhance efficiency.

One of the key benefits of technology in billing and invoicing is the ability to automate repetitive tasks. This includes generating invoices, sending payment reminders, and reconciling accounts. Automation can significantly reduce the time and effort required to manage these processes, allowing businesses to focus on more strategic activities.

Digital tools also offer enhanced accuracy and transparency in financial transactions. By using software solutions, businesses can generate detailed and precise bills and invoices, reducing the risk of errors and discrepancies. Additionally, digital records provide a clear and accessible audit trail, facilitating accurate financial reporting and analysis.

Another advantage of technology in billing and invoicing is the ability to integrate with other financial systems, such as accounting and inventory management software. This integration allows for seamless data exchange and improved coordination between different departments, enhancing overall business efficiency. By embracing technology and automation in billing and invoicing, businesses can improve their financial management, reduce costs, and enhance customer satisfaction.

Frequently Asked Questions

- Can a bill and an invoice be the same document? Yes, in some cases, the terms "bill" and "invoice" may be used interchangeably, particularly in certain regions or industries. However, understanding their distinct functions and purposes is crucial for effective financial management.

- What is the main difference between a bill and an invoice? The primary difference lies in their purpose and timing. A bill is typically issued when immediate payment is required, while an invoice is used when payment is expected within a specified period.

- Are bills and invoices legally binding? Yes, both bills and invoices carry legal implications, serving as formal requests for payment and outlining the terms of the transaction. It's essential for businesses and individuals to understand their obligations and rights under these documents.

- How can businesses ensure accurate billing and invoicing? Implementing best practices, such as using standardized formats, leveraging digital tools, and establishing clear payment terms, can help businesses ensure accurate billing and invoicing.

- What role does technology play in billing and invoicing? Technology and automation have revolutionized billing and invoicing processes, allowing businesses to streamline operations, reduce errors, and enhance efficiency through digital tools and software solutions.

- Why is it important to differentiate between bills and invoices? Understanding the differences between bills and invoices is crucial for effective financial communication, accurate record-keeping, and managing cash flow. It helps avoid misunderstandings and ensures smooth business operations.

Conclusion

The distinction between a bill and an invoice is more than just a matter of semantics; it is a crucial aspect of managing financial transactions effectively. By understanding the unique characteristics and functions of these documents, businesses and individuals can enhance their financial communication, ensure accurate record-keeping, and manage their cash flow more effectively. This comprehensive guide has explored the definitions, components, and legal implications of bills and invoices, providing a thorough understanding of their roles in financial transactions.

Recognizing the differences between bills and invoices allows businesses to tailor their practices to meet the specific needs of their industry and clients. Implementing best practices and leveraging technology can further enhance efficiency, reduce errors, and improve customer satisfaction. By adopting a well-informed approach to managing bills and invoices, businesses can ensure smooth operations, maintain positive relationships with clients and suppliers, and achieve long-term financial success.

As the business landscape continues to evolve, staying informed about the latest trends and advancements in billing and invoicing is essential. Embracing new technologies and practices can provide businesses with a competitive edge, enabling them to adapt to changing market demands and achieve sustainable growth. Ultimately, a clear understanding of the differences between bills and invoices is a valuable asset for anyone involved in financial transactions, providing the foundation for effective financial management and communication.

Article Recommendations

- Goldman Sachs Pwm Associate Salary

- Lisa Raye Height

- Ui For Apache Kafka Value Filter

- Zhang Xueying

- Reflex Compound Bow

- Macd For Ym

- Luisa Baratto

- Price Tag Details

- 3 Way Wiring Diagram

- Claudia Gerini